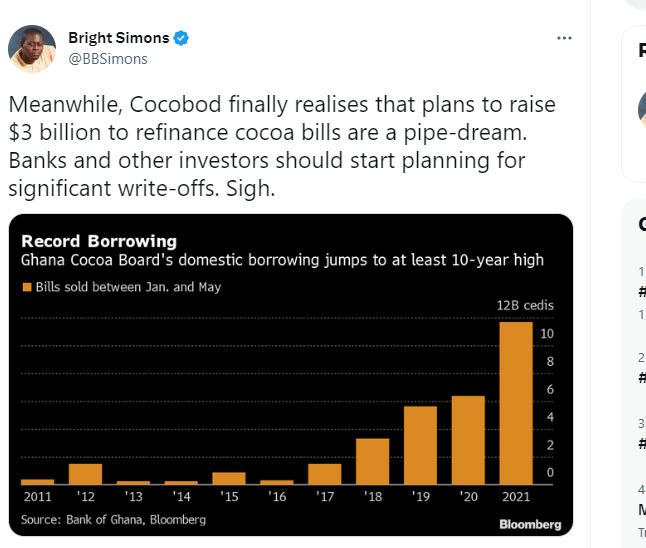

A Vice President of IMANI Africa, Bright Simons has described as a ‘pipe-dream’ Ghana Cocoa Board (COCOBOD) plans to raise $3.0 billion to refinance cocoa bills.

According to him, banks and other investors should plan for significant write-offs.

COCOBOD will later this year seek $3 billion from some international and local lenders to refinance its cocoa purchases.

In a tweet, Mr. Simons said “COCOBOD finally realises that plans to raise $3 billion to refinance cocoa bills are a pipe-dream”.

According to Bloomberg, COCOBOD’s borrowing cost jumped to at least 10-year high. The yield surged to more than 10%.

Cocoa bills default: BoG, COCOBOD agree to allow banks to use COCOBOD’s deposits to pay retail customers

The Bank of Ghana, Ghana Cocoa Board (COCOBOD) and the commercial banks have agreed to allow banks to use COCOBOD’s deposits/placements at the banks to cater for retail customers who may not want a rollover of their cocoa bills.

This is coming after the BoG initially directed banks not to pay customers their maturing cocoa bills investments, following cash flow challenges facing COCOBOD.

In a statement, the Central Bank said it expects that this short-term cash flow challenges facing COCOBOD will be resolved soon to enable the cocoa regulator meet its obligations to investors.

“COCOBOD has assured us that the outlook for the 2023 crop season is good, and Cocoa purchasing are ahead of last year. We therefore expect that this short-term cash flow challenges facing Cocoa Board will be resolved soon to enable COCOBOD to meet its obligations to investors.”