Without assurance from Ghana’s external creditors, it may be impossible to get the $3 billion bailout package from the IMF.

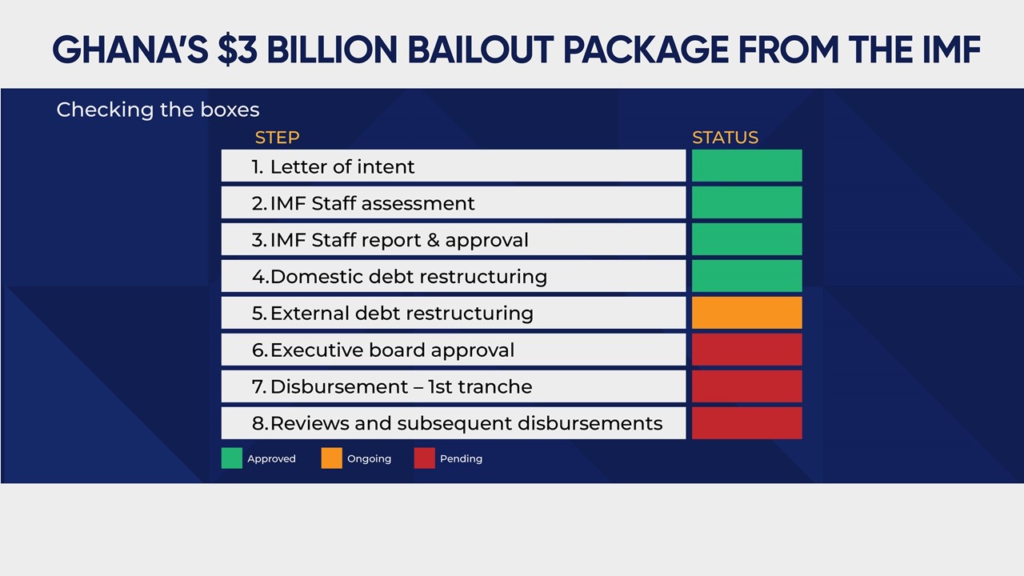

For Ghana to obtain that much-anticipated support from the International Monetary Fund, it must meet certain crucial conditions, and the most pressing has to do with debt restructuring at both domestic and external levels.

For domestic debt restructuring, it’s a bingo! Government has managed to restructure about GHȼ98 billion of its domestic bonds with a participation rate of 85%.

The next hurdle to cross is restructuring at the external level. About 72% of the external debt will be eligible for restructuring – meaning, out of the $31 billion owed to external creditors, $22 billion will undergo debt treatment!

Let’s break this down; out of the $22 billion, $1.6 billion belonging to nonresidents who bought domestic bonds have already been restructured, $14.6 billion is owed to commercial creditors (including Eurobond creditors) while $5.4 billion belongs to bilateral creditors with China and the Paris Club heavily involved.

For most developing economies, the IMF-World Bank spring meeting was an opportunity to exert final pressure on restructuring talks, and Ghana left no stone unturned: nine lawmakers joined a delegation led by Finance Minister, Ken Ofori-Atta, and the Bank of Ghana Governor, Dr Ernest Addison, to convince external creditors to come to the negotiation table.

During the spring meetings, there were a series of calls from different angles urging creditors to fast-track debt operation talks, especially for developing economies.

Zambia remains a test case for most countries attempting a debt operation exercise with China being a significant bilateral creditor. The country’s debt talks have stalled due to a standoff between China and the West on the form of restructuring and the magnitude of losses each side is willing to accommodate.

According to the IMF, Zambia will have access to about $188 million (the first tranche out of a total package of $1.3 billion) in financing once the review is approved by the Fund.

To remove any hurdles to the timely completion of the review, the IMF has told Zambia it needs its official creditors to move forward and reach an agreement on a debt treatment in line with the financing assurances they provided in July 2022.

Ghana’s situation is synonymous with that of Zambia where China appears to be missing at the collective negotiation table.

But while the picture still looks gloomy, Mr Ofori-Atta’s recent tweet offered some glimpse of hope. According to him, Ghana had “productive restructuring talks” with the International Monetary Fund (IMF), International Finance Corporation (IFC) and Japan International Cooperation Agency (JICA), among others.

As Ghana awaits an IMF executive board approval, some of its economic indicators have begun seeing significant improvement; inflation dropped for the third consecutive time in March after reaching a more than two-decade high of 54.1% in December 2022.

The local currency on hand has appreciated cumulatively by more than 10% since the beginning of the year.

However, Ghana’s growth rate has been truncated by the World Bank to 1.6%, lower than government estimates. Worryingly, the debt-to-GDP ratio is projected to touch 99%.

Any support from the West in this whole debt operation exercise should not be seen as a ‘father christmas move’ as the US is becoming increasingly militant in their calls for countries to pick a side in the competition with China.

The kind of concessions Ghana and Zambia have to make to get debt relief will be subject to what they consider pragmatic in their long-term future, and how to manage future concessions with Chinese infrastructure investments will remain a headache.

In all Ghana must have a game plan!

Twitter: @isaackofiagyei